accumulated earnings tax reasonable business needs

Percent of the accumulated taxable income in excess of. The need to retain earnings and profits.

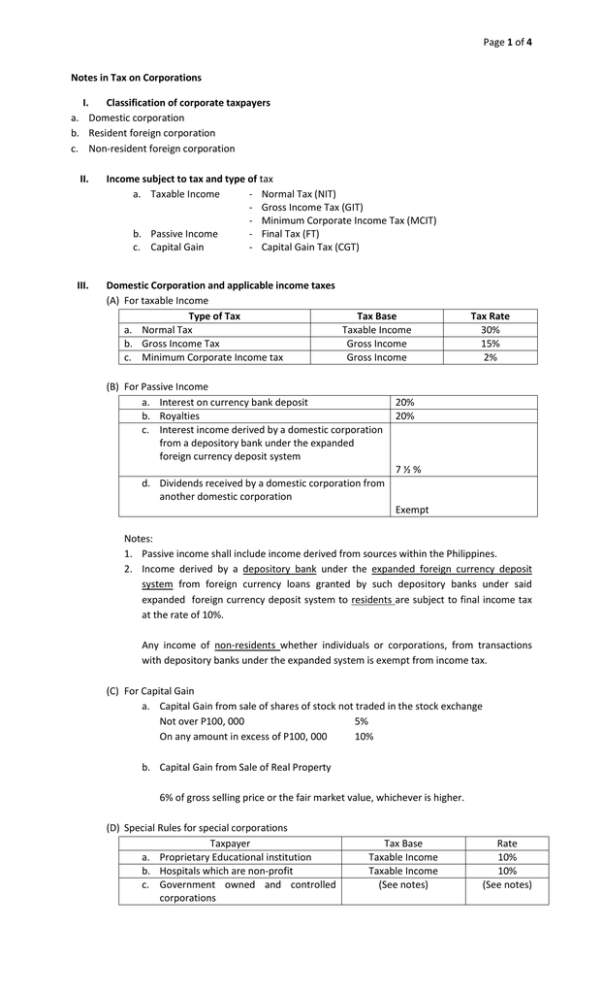

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Tion 303 relating to payment of a deceased shareholders estate taxes.

. And profits have been allowed to accumulate beyond the reasonable. The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172f as in effect before the date of enactment of the Tax Cuts and Jobs Act as determined under regulations prescribed by the Secretary shall be treated as accumulated for the reasonably anticipated needs of the business. And 3 redemptions of stock from a.

In any proceeding before the Tax Court involving the allegation that a corporation has permitted its earnings and profits to accumulate beyond reasonable business needs the burden of proof is on the Commissioner unless a notification is sent to the taxpayer under IRC 534b However if such a notification is sent to the taxpayer and heshe timely submits the. 150000 200000 - 100000 250000. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder-level tax seeSec.

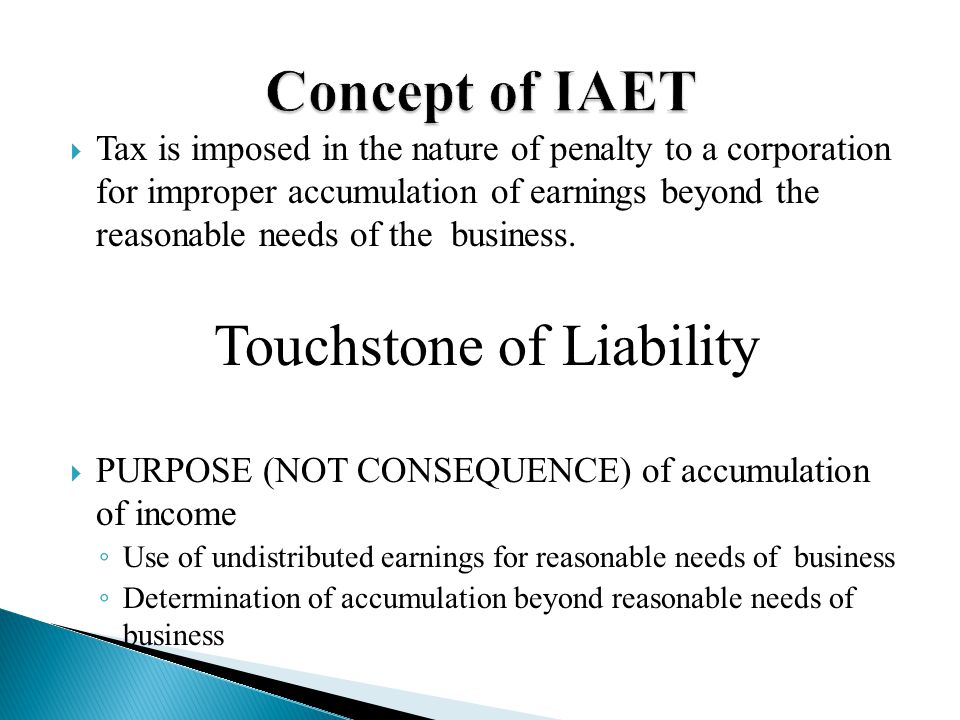

Within the reasonable needs of the business rubric. However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. The key term reasonable needs of the business is so subjective in nature that the tax itself is de facto raised by the IRS.

The fact that earnings and profits of a corporation are permit-ted to accumulate beyond the reasonable needs of the business is prima facie evidence of a purpose to avoid income tax2 One test of a corporations reasonable business needs is the reason-ably anticipated needs of the business3 This figure includes. If the accumulated taxable income satisfies the reasonable needs test then the accumulated earnings tax will be defeated. The primary defense usually levied by the corporation is that the accumulated earnings beyond 25000000 were essential to the reasonable needs of the business.

The Accumulated Earnings Tax The accumulated earnings tax is a penalty tax designed to dis- courage the use of a corporate umbrella for personal income. The need to retain earnings and profits. CODE OF 1954 531.

This subjective test can be satisfied by a variety of business reasons. The Tax Code defines reasonable needs to include the reasonably anticipated needs of the business. 1 Accumulated taxable income is taxable income modified by adjustments in 535 b and as reduced by the dividends paid deduction under 561 and the accumulated earnings tax credit under 535 c.

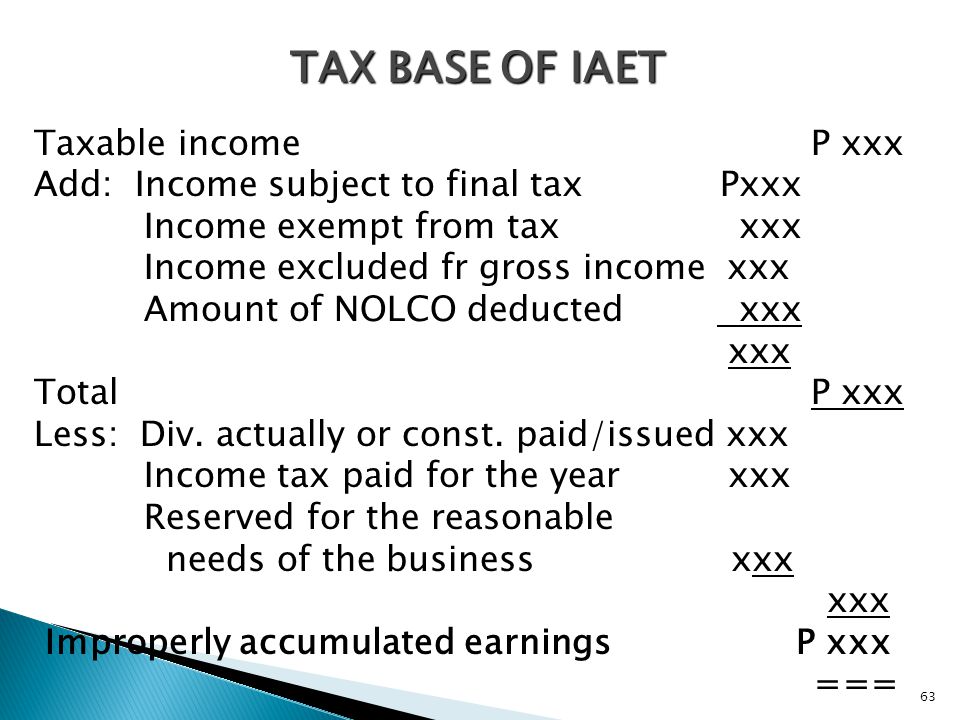

This taxadded as a penalty to a companys income tax liabilityspecifically applies to the companys taxable income less the deduction for dividends paid and a standard accumulated tax credit of. Needs of the business. Dalaguete on October 18 2018 A corporation that permits the accumulation of earnings and profits beyond the reasonable needs of the business is subject to the 10 percent Improperly Accumulated Earnings Tax IAET.

When applicable the accumulated earnings tax is levied at the rate of 27y percent of the first 100000 of accumulated taxable income and at. 1537-2a Income Tax Regs. Strategies for Avoiding the Accumulated Earnings Tax.

The accumulated earnings tax doesnt apply to earnings kept in the business to meet the reasonable needs of the business. To avoid having to pay for accumulated earnings tax Company A has to distribute at least 100000 of net income as dividends. If Company A wishes to.

The AET isnt assessed if accumulated earnings are reasonable in light of business needs IRC Sec. Or The amount of current year earnings and profits that are retained for reasonable business needs in excess of dividends paid to the shareholders less the net capital gains deducted in calculating accumulated taxable. 5 1535- 3b 1 ii.

In periods where corporate tax rates were significantly lower than individual tax rates an obvious. And other qualifying expenses. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the business the corporation may be assessed tax penalty called the accumulated earnings tax IRC section 531 equal to 20 percent 15 prior to 2013 of accumulated taxable income.

An accumulation of the earnings and profits including the undistributed earnings and profits of prior years is in excess of the reasonable needs of the business if it exceeds the amount that a prudent businessman would consider appropriate for the present business purposes and for the reasonably anticipated future needs of the business. Accumulated Earnings Tax IRC 531 The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and. Tion of earnings beyond the reasonable needs of the business betrays the prohibited purpose4 In practice the presumption is virtually con-1.

Anticipated needs of the business. For example IRC Sec. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax.

2 redemptions in connection with sec-. If the accumulation is justified to be within the reasonable needs of the business the IAET is not imposed. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

Accumulated earnings can be reduced by dividends actually or deemed paid and corporations are entitled to an accumulated earnings credit which will be the greater of 1 a minimum of a 250000. Net Liauid Assets The accumulated earnings and profits of prior years are taken into consideration in determining whether any amount of the earnings and profits of the taxable year has been retained for the reasonable needs of the business. 1537-1 provide that earnings dont have to be used for an immediate business needcorporations may retain earnings to.

REASONABLE NEEDS OF THE BUSINESS. The tax is in addition to the. The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax.

The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. 250000 or 150000 for personal service corporations less the amount of accumulated earnings and profits at the end of last tax year.

Taxation Of Shareholder Loans Canadian Tax Lawyer Analysis

The Income Tax Rate Of Corporations Lowered In The Philippines Lawyers In The Philippines

Income Tax Computation For Corporate Taxpayers Prepared By

Solved Pera Pera College An Educational Institution Provided The Following Data For The Current Year Income From Tuition Fees P3 000 000 School Course Hero

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc Tax And Accounting Center Inc

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Solved Pera Pera College An Educational Institution Provided The Following Data For The Current Year Income From Tuition Fees P3 000 000 School Course Hero

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

How To Prepare Corporation Income Tax Return For Business In Canada

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

:max_bytes(150000):strip_icc()/GettyImages-1128492098-f6606fdc398b4e0bbecbe4c2fe8493eb.jpg)

Accumulated Earnings Tax Definition

:max_bytes(150000):strip_icc()/GettyImages-1089395350-f33f180d2b234b268f6df527045f8de0.jpg)

Accumulated Earnings Tax Definition

Improperly Accumulated Earnings Mpcamaso Associates

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download